This is a great piece of land in a great neighborhood. A long history of active exploration and mining has defined a prolific, regional structure that stretches hundreds of kilometers - and Enchi covers a significant part of it with district-scale, multi-million-ounce potential.

Greg Smith, VP Exploration

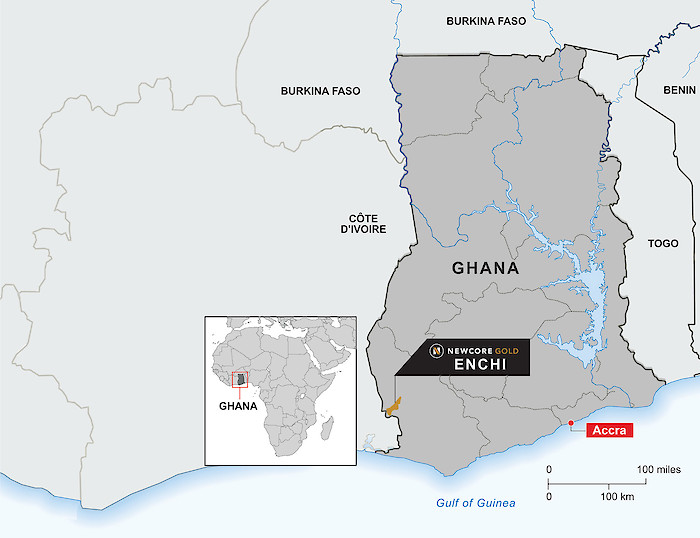

| Locations: | Southwest Ghana |

| Minerals | Gold (Au) |

| Area | 248 km2 |

| Ownership | 100% |

| Status | Indicated Mineral Resource1 of 743,500 ounces of gold at 0.55 g/t and an Inferred Mineral Resource1 of 972,000 ounces of gold at 0.65 g/t |

Overview: On Trend with Some of Ghana’s Most Successful Mines

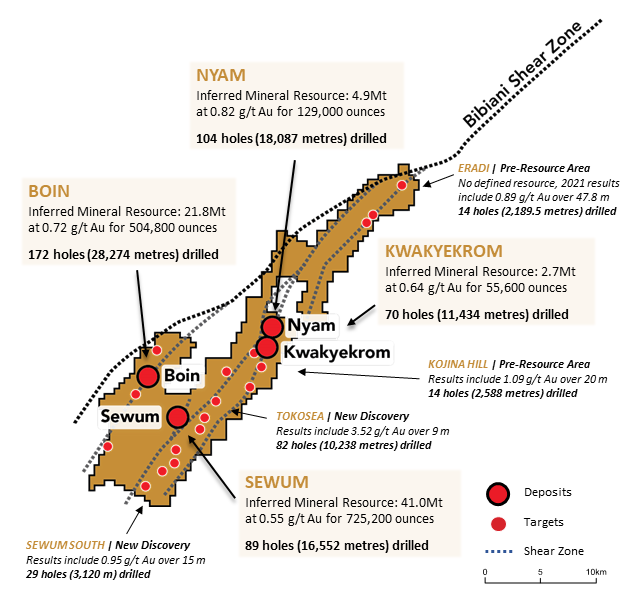

The Enchi Gold Project currently hosts an Indicated Mineral Resource1 of 743,500 ounces of gold at 0.55 g/t and an Inferred Mineral Resource1 of 972,000 ounces of gold at 0.65 g/t in a district hosting several 5 million-ounce gold deposits. This 248 km2 land package covers 40 kilometers of Ghana’s prolific Bibiani Shear Zone. The property remains substantially underexplored, with several high priority geochemical and geophysical anomalies yet to be tested by drilling.

On Structure with the Chirano Mine

The Chirano Mine, owned by Asante Gold (previously Kinross Gold), is located 50 kilometers to the north. Chirano produced ~155,000 ounces of gold in 2021 and ~165,000 ounces of gold in 2020. Enchi is situated on the same regional structure as Chirano with comparable geology, alteration and mineralization.

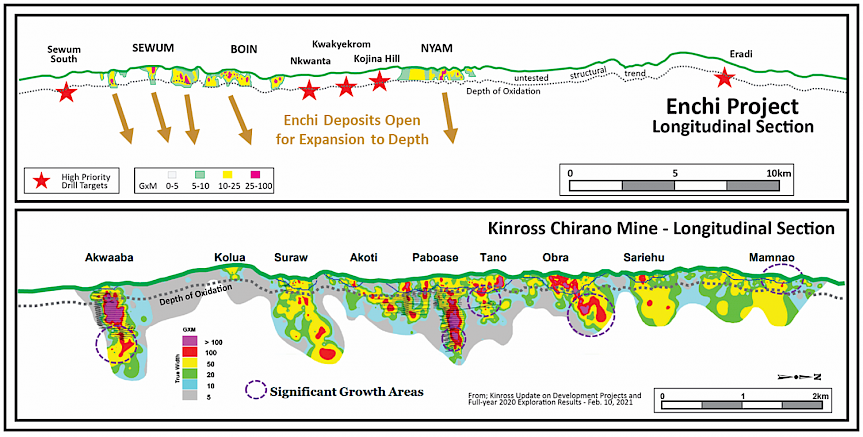

Depth Potential - Comparison with Chirano Mine

The multi-million-ounce Chirano Gold Mine (owned by Asante Gold) hosts plunging zones of high-grade gold mineralization (see diagram below). The Chirano zones are similar to those found at Enchi, including known zones Sewum, Boin, Nyam and Kwakyekrom. Like Chirano, the zones at Enchi have broad lower grade gold at surface with higher grade core structure extending to depth.

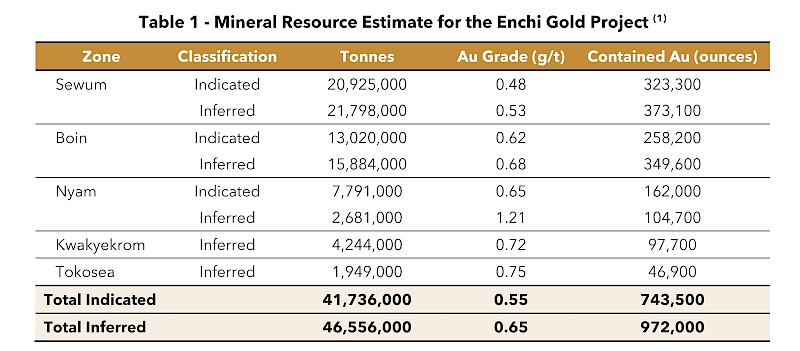

Current Mineral Resource Estimate

Newcore Gold announced the results of an updated, independent, Mineral Resource Estimate prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) for the Enchi Gold Project on March 7, 2023. The Resource was completed by BBA E&C Inc. of Sudbury, Ontario, Canada. The technical report, titled "Mineral Resource Estimate for the Enchi Gold Project" has an effective date of January 25, 2023, is reported using a gold price of US$1,650 per ounce, and is available under the Company’s profile on SEDAR at www.sedar.com as well as on Newcore's website. The updated 2023 Mineral Resource Estimate:

(i) Successfully outlined an inaugural Indicated Mineral Resource of 743,500 gold ounces with substantial conversion from the Inferred category to the Indicated category, de-risking project development;

(ii) Defined an Inferred Mineral Resource of 972,000 gold ounces;

(iii) Established a high-grade underground resource for the first time of 135,900 gold ounces at an average grade of 2.42 g/t gold, proof of concept that outlines the potential for longer-term resource growth from sulphide mineralisation;

(iv) Added a fifth deposit at Enchi, with an inaugural Inferred Mineral Resource at Tokosea of 46,900 ounces, proving out the potential for mine life extension from the district scale exploration opportunity at the Project;

(v) Does not include approximately 38,000 metres of drilling which focused on greenfield discoveries and high-grade sulphide mineralisation at depth, highlighting the multi-million-ounce potential of the 216 km2 district scale property; and

(vi) Further supports and de-risks the strong economics outlined in the 2021 Preliminary Economic Assessment.

The Mineral Resource Estimate has an effective date of January 25, 2023, is reported using a constraining resource pit at a gold price of US$1,650 per ounce, and consists of:

- Indicated Mineral Resource of 743,500 ounces of gold at an average grade of 0.55 g/t Au and totalling 41,736,000 tonnes; and

- Inferred Mineral Resource of 972,000 ounces of gold at an average grade of 0.65 g/t Au and totalling 46,556,000 tonnes.

- Underground Inferred Mineral Resource of 135,900 ounces gold at 2.42 g/t Au.

- Initial Inferred Mineral Resource at Tokosea of 46,900 ounces gold at 0.75 g/t Au.

- A higher-grade subset of the open pit Resource, using a 0.50 cut-off grade, consists of an Indicated Mineral Resource of 493,700 ounces of gold at an average grade of 0.97 g/t Au and an Inferred Mineral Resource of 580,900 ounces of gold at an average grade of 1.04 g/t Au. This does not include the underground Inferred Mineral Resource of 135,900 ounces at an average grade of 2.42 g/t Au.

1 Notes for Mineral Resource Estimate:

1. Canadian Institute of Mining Metallurgy and Petroleum ("CIM") definition standards were followed for the resource estimate.

2. The 2023 resource models used ordinary kriging (OK) grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids and constrained by pits shell for Sewum, Boin and Nyam. Kwakyekrom and Tokosea used Inverse Distance squared (ID2).

3. Open pit cut-off grades varied from 0.14 g/t to 0.25 g/t Au based on mining and processing costs as well as the recoveries in different weathered material.

4. Heap leach cut-off grade varied from 0.14 g/t to 0.19 g/t in the pit shell and 1.50 g/t for underground based on mining costs, metallurgical recovery, milling costs and G&A costs.

5. CIL cut off grade varied from 0.25 g/t to 0.27 g/t in a pit shell and 1.50 g/t for underground based on mining costs, metallurgical recovery, milling costs and G&A costs.

6. A US$1,650/ounce gold price was used to determine the cut-off grade.

7. Metallurgical recoveries have been applied to five individual deposits and in each case three material types (oxide, transition, and fresh rock).

8. A density of 2.19 g/cm3 for oxide, 2.45 g/cm3 for transition, and 2.72 g/cm3 for fresh rock was applied.

9. Optimization pit slope angles varied based on the rock types.

10. Reasonable mining shapes constrain the mineral resource in close proximity to the pit shell.

11. Mineral Resources that are not mineral reserves do not have economic viability. Numbers may not add due to rounding.

12. The resource estimate was prepared by Todd McCracken, P.Geo, of BBA E&C Inc. in accordance with NI 43-101. Todd McCracken is an independent qualified person as defined by NI 43-101. A full technical report is avilable under Newcore's SEDAR profile at www.sedar.com.

The 2023 Mineral Resource Estimate builds on the last completed Mineral Resource Estimate released on June 8, 2021 and incorporates approximately 34,000 metres of infill and resource expansion Reverse Circulation and diamond drilling completed by Newcore between January 2021 and July 2022. Of the 92,583 metres of drilling completed since 2020, approximately 38,000 metres has yet to be incorporated into a mineral resource estimate; this drilling continues to prove out the future resource growth potential at Enchi as these metres highlighted new greenfield discoveries and the potential for high-grade sulphide mineralisation at depth, showcasing the district scale exploration opportunity at Enchi.

Read the March 7, 2023 news release or review the technical report for full details.

Excellent Resource Expansion Potential - Laterally and at Depth

Drilling completed at Enchi has averaged a depth of 100 metres to date, with a handful of holes testing a maximum vertical depth of 350 metres in one zone (Nyam). Most resources and reserves of mines on the Bibiani Trend lie below 200 metres.

Several high-priority gold targets have been identified to expand the already substantial, near-surface oxide resource with multi-million ounce opportunities. Considering the positive results of the latest resource update, the shallow drilling completed to date and number of untested anomalies, there is excellent potential to expand the current resource.

2020 - 2022 Enchi Drilling Program

A 90,000 metre discovery and resource expansion drilling program was completed at Enchi in Q2 2022. The program included both RC and diamond drilling and included the first deeper drilling to be completed on the Project. RC drilling focused on near-surface oxide gold targets while diamond drilling focused on targets at depth. Newcore’s multi-pronged exploration approach delivered on its goals: (i) Successfully outlined the potential resource growth along strike at all four deposits (Sewum, Boin, Nyam, Kwakyekrom); (ii) Encountered strong results at previously drilled zones outside of the resource area (Kojina Hill, Eradi); (iii) Intersected high-grade gold at depth, outlining the potential to delineate underground resources; and (iv) Identified new discoveries from successful first pass drilling on early-stage targets (Sewum South, Tokosea, Sewum Ext. Parallel Structure).

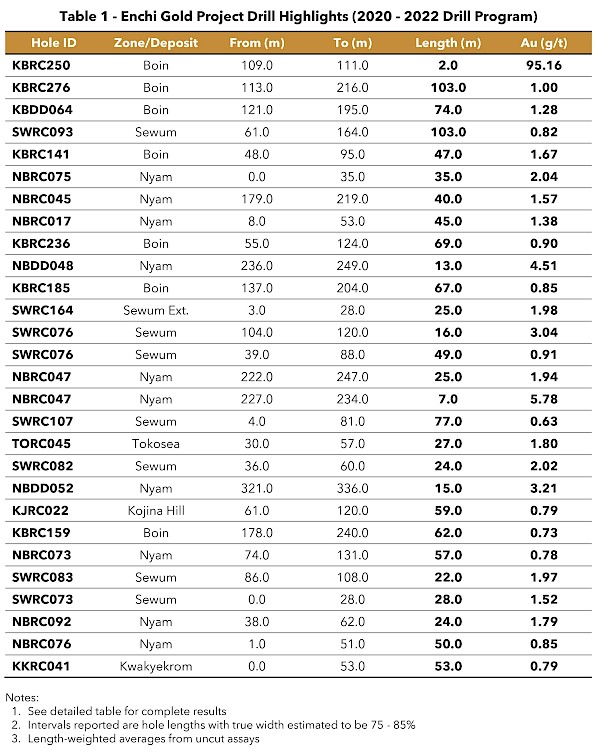

Highlights from the 2020 - 2022 Drill Program at Enchi:

- Largest drill program to ever be completed at Enchi (92,583 metres) with results highlighting the potential for significant resource growth across the Project.

- All deposits and targets remain open along strike and at depth, with drill results highlighting the potential for resource growth in both shallow oxides and at depth.

- Drilling intersected the highest-grade gold interval to date, outside the limits of the pit-constrained mineral resource area.

- RC hole KBRC250 at Boin intersected 95.16 g/t Au over 2.0 m from 109 m.

- Deepest Drilling to Date Completed on the Project, Intersected High-Grade Mineralization in the Sulphides.

- Drilling at Nyam defined two northerly plunging high-grade zones down to a depth of 300 metres which remain open for further expansion. Results include hole NBDD048 which intersected 4.51 g/t Au over 13.0 m from 236 m.

- Three New Discoveries from First Pass Drilling on New Structures.

- Drilling on a parallel structure at Sewum Extension, located 200 metres east of the Sewum Deposit, intersected 1.98 g/t Au over 25.0 m from 3.0 m in hole SWRC164.

- Shallow drilling on two of the largest untested anomalies at Enchi, Sewum South and Tokosea, showcased the potential for additional resource areas across the property.

The 2020 - 2022 drill program consisted of 575 holes representing 92,583 metres. The current Mineral Resource Estimate (completed June 2021) incorporated 20,195 metres of this drilling. Select highlighted assay results from the drill program are below:

A complete list of the 2020 - 2022 drill results, including hole details, can be viewed at:

https://newcoregold.com/site/assets/files/5776/2022_07-ncau-enchi-2020-2022-drill-results-l.pdf

See July 27, 2022 news release for a detailed overview of the drill program:

https://newcoregold.com/news/newcore-gold-completes-90-000-metre-drill-program-significantly-expanding-the-mineralized-footprint-at-the-enchi-gold-project/

An updated Inferred Mineral Resource Estimate was announced in conjunction with an updated Preliminary Economic Assessment Study on June 8, 2021. The update incorporated 20,195 metres of drilling completed as part of the 2020 - 2022 drill program.

The 2020 - 2022 drill program was the largest drill program to ever be completed on the Project and was successful in highlighting the district scale potential across the 248 km2 property and the strong potential to delineate additional resources at Enchi.

Subscribe

Subscribe